Payments are the final step in closing a commercial contract and indicate that the transaction was successful. An iGaming payment gateway is an essential function in the vast world of e-commerce is to act as a connecting link between customers and sellers. This essential element serves as a security measure for sensitive data, guaranteeing the safe administration of payment procedures and client information.

The payment gateway functions as a secure system that expertly manages credit card costs for online shoppers and authorizes payments. Serving as a dependable protector, it promotes a safe and secure exchange of money, fulfilling the primary goal of enabling smooth online transactions.

This article seeks to shed light on the importance of choosing the best iGaming payment option for your online business. To make things easy for you, this article will examine and offer a thorough guide to make sure you take into account important factors that are in line with your e-commerce business’s requirements.

Safety and Adherence to Regulations

In the world of iGaming payment gateways, security, and compliance are critical due to the sensitive nature of financial transactions and the possible dangers involved. Payment gateways, which operate as middlemen between financial institutions and businesses, are essential to guaranteeing the secure transfer of payments between customers and enterprises.

Choosing a payment solution with strong encryption and fraud protection features, as well as compliance with industry security standards such as PCI DSS (Payment Card Industry Data Security Standard), is imperative. A secure payment channel protects sensitive data and fosters client trust. Customers and the business both gain from compliance with standards like PCI DSS and GDPR (General Data Protection Regulation), which provide an additional degree of safety and security and help maintain a reliable and secure financial environment.

Integration and Compatibility

To gain and keep the trust of customers and comply with legislation that is specific to a given demography, e-commerce businesses must partner with iGaming payment gateways that offer the highest level of protection. It is critical to understand that security and compliance are continual processes that call for constant attention and modification in response to new threats and changes in the law.

Like the adage “not everyone can handle everything,” integration support is necessary for an iGaming payment gateway. Choosing a payment gateway that works well with your website or e-commerce platform is crucial. Therefore, selecting payment gateways that provide plugins, APIs, or pre-configured integrations with well-known e-commerce platforms is essential to supporting the expansion of your online business and guaranteeing efficient iGaming payment processing.

Furthermore, confirming that the selected payment gateway is compatible with your invoicing or recurring billing software guarantees automated updating of billing and invoice data, which saves time, reduces manual labor, and maintains precise payment tracking.

Variety and Range in Payment Options

Online payments are becoming a crucial component of any e-commerce endeavor in today’s tech-driven society. It is important to take into account the many payment options that customers prefer, depending on what they find convenient and trustworthy. Choosing a payment gateway that corresponds with your customers’ preferences is crucial in this regard.

This improves the entire transaction experience while also protecting you and your clients from possible annoyances during the closing phases of a transaction. Therefore, it is important to choose a payment gateway that lets customers pay through various payment methods, such as cash, digital/mobile wallets (like PayPal, Apple Pay, or Google Pay), credit/debit cards, and online bank transfers.

Furthermore, adding alternate payment options, such as buy now, and pay later services, can improve customer convenience and possibly increase conversion rates. Since many e-commerce customers quit checkout owing to insufficient payment options, failing to support customers’ chosen payment methods may have negative consequences like revenue loss, cart abandonment, and diminished customer loyalty.

Assistance and Service for Customers

When working with large amounts, particularly those in the hundreds or thousands, a thoughtful approach is necessary. Reliable customer service becomes critical, especially in the event of technological difficulties or while looking for help with payment options. Every hour, e-commerce businesses see large amounts of money pass through payment gateways; therefore, any error or outage could result in a huge loss.

The customer assistance provided by the iGaming payment gateway should be available 24/7 to help you through these crucial times and protect your organization from major setbacks. Choosing payment gateways with prompt customer service and clear documentation is essential. A strong support network guarantees quick problem-solving, reducing downtime and bolstering the stability of your company’s operations.

Conclusion

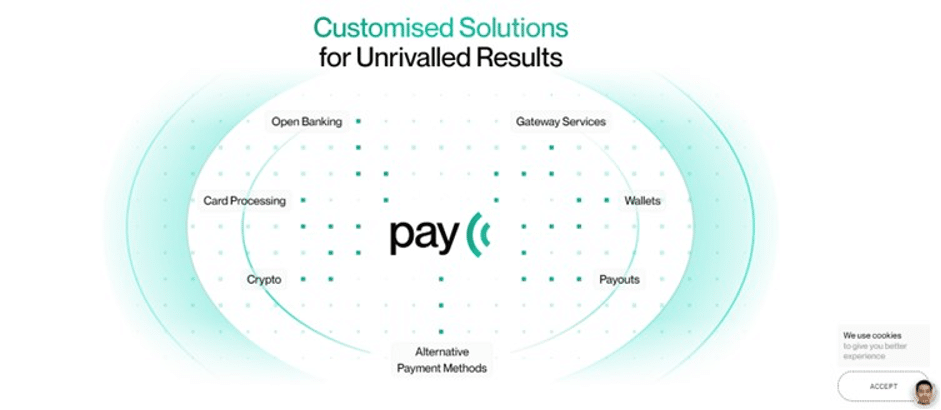

Choosing the appropriate iGaming payment gateway, such as Pay.cc, for your online business is a crucial decision that will greatly affect its success. To find the best fit for your unique business needs, do extensive research on several suppliers and compare their features, costs, and client reviews. After you’ve made a choice, move forward with putting the selected payment gateway into place and continuously monitor and improve the high-risk payment processing to guarantee a seamless and happy customer experience.