Singapore’s housing market offers diverse options, but executive condominiums stand out as a unique proposition for middle-income families. These properties like Rivelle Tampines bridge the gap between HDB flats and private condominiums, offering premium living experiences at accessible price points. Developed by private developers on government land, ECs combine quality construction with affordability that creates genuine wealth-building opportunities.

The appeal extends beyond initial pricing. Executive condominiums appreciate significantly over time, particularly those in strategic locations with strong infrastructure. This appreciation potential, combined with the ability to eventually sell on the open market or rent out the property, makes ECs compelling long-term investments for eligible buyers who understand market dynamics.

Location Intelligence: Why the Eastern Region Commands Attention

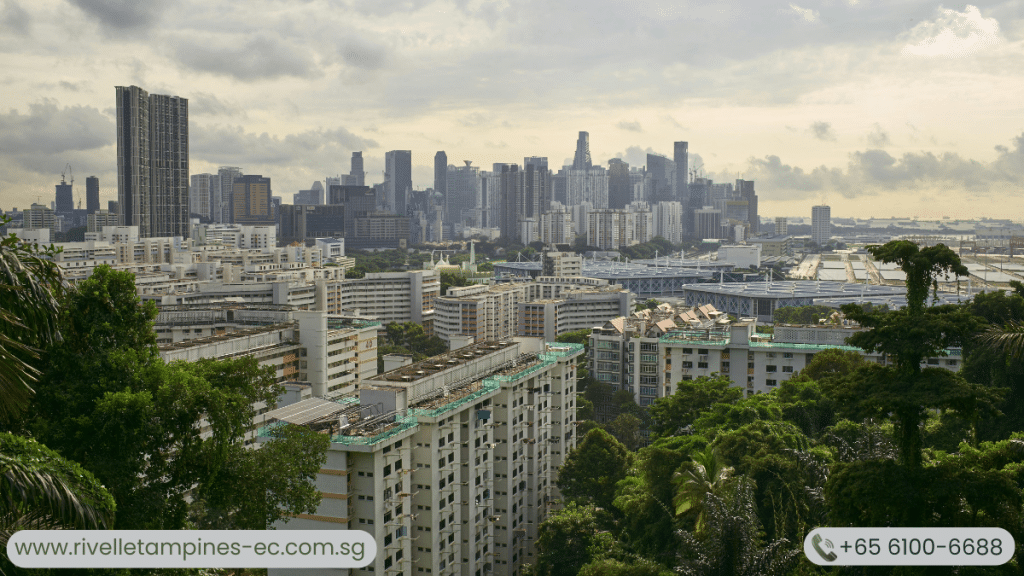

Location fundamentally determines both lifestyle quality and investment returns in real estate. The Eastern corridor of Singapore, particularly mature townships, offers established infrastructure that newer developments cannot replicate overnight. When considering executive condominiums, proximity to comprehensive amenities, transportation networks, and educational institutions creates immediate value.

Rivelle Tampines represents this location advantage perfectly. Situated in Singapore’s first regional center, such developments benefit from decades of infrastructure maturity. Residents enjoy self-sufficient ecosystems where shopping, dining, healthcare, and entertainment exist within comfortable reach. This convenience translates directly into quality of life improvements and property value stability.

Connectivity amplifies location benefits exponentially. Properties within walking distance of MRT stations command premium valuations because daily time savings compound into thousands of reclaimed hours over years of residence. The Eastern region’s excellent connectivity through multiple MRT lines and major expressways like the Tampines Expressway provides mobility flexibility that modern families demand.

The Educational Proximity Premium

Education drives significant portions of Singapore’s property demand, creating powerful value dynamics around reputable schools. The Ministry of Education’s distance-based priority system for primary school registration makes proximity literally valuable. Parents understand that living within one kilometer of desired schools dramatically improves admission chances during critical registration phases.

This reality embeds educational access directly into property valuations. Developments near established primary schools maintain stable demand as each new generation of parents seeks enrollment advantages. Beyond primary education, accessibility to secondary schools and junior colleges adds layers of long-term value for families planning extended residence periods.

The Tampines area hosts numerous respected educational institutions across all levels, creating comprehensive educational infrastructure that attracts family-oriented buyers. This concentration of quality schools provides assurance that children can complete their entire educational journey without requiring family relocations.

Developer Credibility: The Foundation of Quality

While location captures immediate attention, developer track records deserve equal scrutiny. Established developers bring construction quality, project management expertise, and financial stability that directly impact buyer outcomes. Their material choices, construction methodologies, and subcontractor management affect how properties age over decades.

Reputable developers maintain quality standards extending well beyond Temporary Occupation Permit dates. They select durable materials, implement rigorous quality controls, and address defects responsibly. These practices translate into lower long-term maintenance costs and better value retention during eventual resale periods.

Financial stability matters equally. Established firms with strong balance sheets navigate economic uncertainties smoothly, reducing risks of construction delays or quality compromises. Their relationships with financial institutions, contractors, and regulatory bodies facilitate reliable project execution that protects buyer interests throughout development timelines.

Navigating the Minimum Occupation Period Strategically

The five-year Minimum Occupation Period shapes EC investment strategies fundamentally. This requirement ensures executive condominiums serve their intended purpose of providing quality housing rather than becoming speculative vehicles. Strategic buyers view the MOP as wealth accumulation opportunities through forced savings and property appreciation.

During the MOP period, owners build equity while servicing mortgages and potentially benefiting from property value appreciation. Historical data shows well-located ECs typically appreciate meaningfully over their first five years, though past performance never guarantees future results. The key lies in selecting developments with strong locational fundamentals that support value growth.

Post-MOP flexibility opens significant opportunities. After fulfilling the five-year requirement, owners can sell on the open market or rent out entire units. This transition represents strategic decision points: continue residing in appreciated properties, leverage accumulated equity for upgrading, or convert properties into rental income streams. The Rivelle Tampines EC and similar well-positioned developments stand to benefit from these post-MOP opportunities given their strong locational advantages in established townships.

Financial Planning for Sustainable Ownership

Mortgage planning requires attention to regulatory frameworks and personal circumstances. The Mortgage Servicing Ratio caps monthly loan repayments at 30% of gross monthly income for ECs during their initial period. Total Debt Servicing Ratio limits total debt obligations to 55% of gross monthly income, encompassing all existing loans and commitments.

Understanding these limits helps buyers structure sustainable purchases. The goal isn’t maximizing loan amounts but creating comfortable financial arrangements aligned with income stability and growth trajectories. Building buffers against potential interest rate fluctuations protects quality of life while ensuring consistent repayment capabilities.

Down payment strategies warrant careful consideration. While CPF savings can cover down payments and monthly installments, maintaining adequate CPF balances for retirement remains important. Striking appropriate balances between maximizing property purchases and safeguarding retirement adequacy requires honest assessment of long-term financial goals beyond immediate housing needs.

Amenities That Matter: Beyond Marketing Brochures

Modern executive condominiums compete on lifestyle offerings, not just basic housing provision. Comprehensive amenities enhance daily living while significantly boosting resale appeal. Today’s developments feature resort-style facilities: expansive swimming pools, well-equipped gymnasiums, function rooms, children’s play areas, and landscaped gardens.

Smart facility planning considers actual usage patterns rather than simply maximizing amenity counts. A well-appointed, spacious gym with quality equipment outperforms cramped facilities with numerous but inferior machines. Similarly, thoughtfully designed communal areas that genuinely facilitate social interaction prove more valuable than multiple underutilized spaces created purely for marketing purposes.

These amenities serve dual purposes—enhancing resident experiences while attracting future buyers during resale. Property tours consistently show that facility quality influences purchase decisions. Well-maintained, generously proportioned amenity areas signal developer commitment to genuine lifestyle value rather than merely checking regulatory requirements.

Market Timing and Purchase Strategy

While perfect market timing remains impossible, awareness of property cycles helps identify favorable purchase windows. Launch phase purchases often secure best pricing as developers incentivize early commitments through attractive discounts. These savings can represent significant value compared to later transaction prices.

However, launch purchases require confidence in developers, acceptance of construction timelines, and commitment despite market uncertainties. Buyers must balance potential savings against the delayed gratification of waiting for project completion. Understanding personal risk tolerance and residential timelines guides appropriate entry point decisions.

Monitoring government policies provides crucial context. Changes to stamp duties, loan-to-value ratios, or eligibility criteria can swiftly alter market dynamics. Staying informed about policy directions helps buyers anticipate market shifts and structure purchases strategically within evolving regulatory frameworks.

Future-Proofing Through Master Plan Awareness

Singapore’s meticulous urban planning through URA Master Plans reveals future neighborhood transformations. Studying these plans identifies areas designated for commercial expansion, recreational enhancements, or infrastructure improvements. Properties positioned to benefit from planned developments often appreciate as visions materialize into reality.

Regional center designations carry particular significance. Areas identified as regional centers receive sustained government investment in commercial, employment, and community infrastructure. This commitment creates long-term appreciation potential that benefits property owners throughout these precincts over extended holding periods.

The Tampines area’s status as an established regional center with ongoing enhancements provides confidence in sustained infrastructure support and economic vitality that protects property values across market cycles.

Conclusion: Making Informed Investment Decisions

Executive condominium investments offer compelling value propositions for eligible buyers approaching decisions strategically. Success requires balancing location and connectivity, educational access, developer credibility, financial sustainability, and personal lifestyle needs. No single factor determines outcomes—rather, combinations of strengths across evaluation criteria separate excellent investments from mediocre ones.

The most successful EC buyers share common characteristics: thorough research habits, honest assessment of personal circumstances, medium-term residential commitment, and financial discipline. They understand ECs serve dual purposes as homes and investments, with living experience quality being equally important as financial returns.

For families committed to Singapore, seeking quality living environments, and building long-term wealth through property ownership, executive condominiums offer proven pathways to achieving these interconnected goals. The key lies in disciplined decision-making grounded in comprehensive analysis rather than emotional reactions or speculative hopes.